The Role of Tokenization in Online Payments

The Role of Tokenization in Online Payments

Understanding Tokenization

What is tokenization?

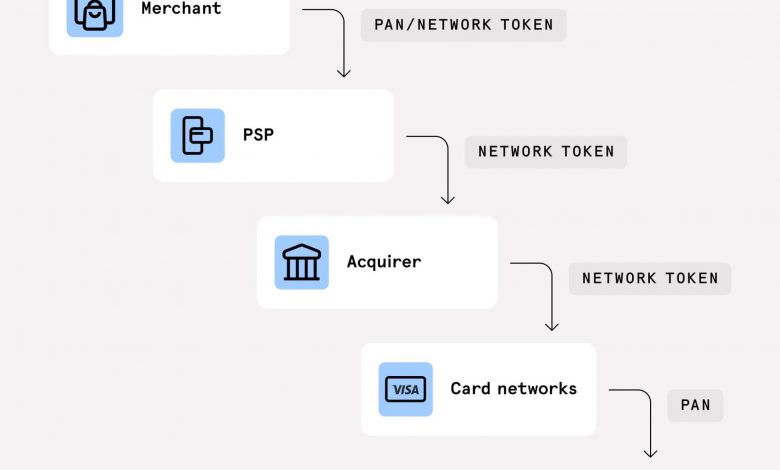

Tokenization is a process of substituting sensitive data with a unique identifier called a token. In the context of online payments, it involves replacing credit card information with a randomly generated alphanumeric token.

How does tokenization work?

When a customer makes a purchase online, the payment gateway captures their credit card details and sends it to a secure tokenization system. This system replaces the card information with a token and stores it securely. The token is then used for future transactions, eliminating the need to transmit sensitive information every time.

The Benefits of Tokenization

Enhanced security

Tokenization significantly reduces the risk of data breaches during online transactions. Since the merchant stores tokens instead of actual card details, even if a hacker gains access to the database, they will only find useless tokens instead of valuable payment information.

Streamlined payment process

With tokenization, customers don’t need to enter their credit card details for every purchase. They can simply use the token, making the payment process faster and more convenient. It also eliminates the need to update payment information when a card is lost or expires.

Compliance with industry standards

Tokenization helps businesses comply with Payment Card Industry Data Security Standard (PCI DSS) requirements. By replacing sensitive data with tokens, merchants can limit their PCI DSS scope and reduce the burden of maintaining payment security.

Frequently Asked Questions (FAQs)

Is tokenization only used for credit cards?

No, tokenization can be used for various types of sensitive data, such as bank account numbers, social security numbers, and personal identification information.

Do customers need to be concerned about the security of tokens?

No, tokens are randomly generated and have no meaning outside of the payment system. They cannot be reverse-engineered to obtain sensitive information, making them highly secure.

Is tokenization compatible with multiple payment methods?

Yes, tokenization can be used with different payment methods, including credit cards, debit cards, and digital wallets. The tokenization system translates the specific payment method into a token, ensuring seamless compatibility.

Does tokenization protect against all types of fraud?

While tokenization is a powerful security measure, it doesn’t protect against all types of fraud. It mainly focuses on securing cardholder data during online payments. Merchants should implement additional security measures, such as fraud detection systems, to combat other types of fraud.

In conclusion, tokenization plays a vital role in enhancing the security of online payments while streamlining the payment process for both merchants and customers. By substituting sensitive cardholder data with tokens, businesses can significantly reduce the risk of data breaches and comply with industry standards. Implementing tokenization technology is a smart move for any business handling online transactions.

Remember, if you have any more questions or concerns about tokenization and its implementation, consult with a trusted payment solution provider or contact us directly.